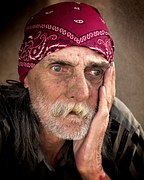

A Peek Into a Real 1%er

Too showy for this 1%er.

It is not easy to peek into the mind of a top tier 1%er for most of us 99%ers, no matter how close we are to the cut-off line. They travel in different groups, socialize with their own limited peers and generally frequent places that we don’t get admitted to or where the price of admission would not be justified even for those with ‘entry-level’ seven figure net worths.

Raman Venkatesh is the founder of Ten Factorial Rocks. Raman is a ‘Gen X’ corporate executive in his mid 40’s. In addition to having a Ph.D. in engineering, he has worked in almost all continents of the world. Ten Factorial Rocks (TFR) was created to chronicle his journey towards retirement while sharing his views on the absurdities and pitfalls along the way. The name was taken from the mathematical function 10! (ten factorial) which is equal to 10 x 9 x 8 x 7 x 6 x 5 x 4 x 3 x 2 x 1 = 3,628,800.