The personal finance blogging world is filled with three categories of people who put out good content:

Jim Rogers is clearly Category A, but does he even blog?

A) People who are open about both their net worth and their identity. They track their net worth vigorously and update frequently. They also post their pictures and their family’s including their travelogues. These blogs generally have a much higher readership, understandably, because this is about as transparent as you can get. A reader sitting 10,000 miles away knows as much about you as a neighbor or a friend. These bloggers provide an excitingly vicarious experience for readers. This is liberating and also, bold in some ways.

Category B: Either you see me or my numbers, but not both!

B) This category involves bloggers who make a very clear choice between net worth or identity. Some believe it is better to be open about who you are but not how much you make or have. This type of folks imply they are financially independent or retired early (FIRE) but don’t share numbers. They focus more on life, travel and family experiences in their blog – plenty of pictures are included. Readers know their names, places and even bond over shared experiences. This is a friendly, socially-active group of PF bloggers. They generally have a strong, loyal readership as well.

Another type within this category believes that in the world of personal finance, it is better to be open about net worth but guard their identity so that people who know them in real life don’t know their financial status. This category of bloggers also have a strong readership base, because all FIRE enthusiasts want to learn real stories of people who have made it or are trying hard to get there. So, the numbers make it real even if you don’t know the person behind the numbers well.

Category C: Channel Yoda, but show neither the face nor numbers

C) The third category includes bloggers like me who have chosen to mask both their identity and net worth data. There aren’t many in this category but clearly, this group generally has less number of regular readers. It is easy to understand why. 😉

Besides, it is enormously difficult, as I have learned, to build readership growth when you are both anonymous and share no “credentials” on personal finance. Ten Factorial Rocks has so far belonged in this category.

Despite that, I am grateful for the unexpectedly high readership statistics this site has seen in the first year.

But no longer….

I have been talking to a good friend of mine, Brian, who is the CEO of a successful company. Brian is a man I respect immensely, and he is also the guy who graciously wrote the foreword to my e-book “The Four Secrets“, which I offer to those people who consult with me.

Brian advised me that to build credibility as a personal finance “coach” in the online world, it is better to share net worth data instead of identity so that more people are inspired to follow the FI journey. He said it makes all my articles have more impact, knowing it is coming from a guy who’s been there and done that. After thinking about it, I realized he is correct. There are too many personal finance posts on the internet with too many claims and ‘how to’s by authors who have questionable credentials. While the content itself is a good filter on quality, specific information on finances helps indeed.

Importantly, if you want to grow your net worth or even aspire to get to a seven figure net worth someday, who do you want to take advice from? From someone who has accumulated a sizable net worth after having traveled the path or from a ‘salesman’ in the garb of a financial planner?

Besides, having chosen a net worth target as the site’s name, I realized this needs to happen anyway one day or another.

So, I have decided to share my financial data with you all, while continuing to remain “Mr. TFR”.

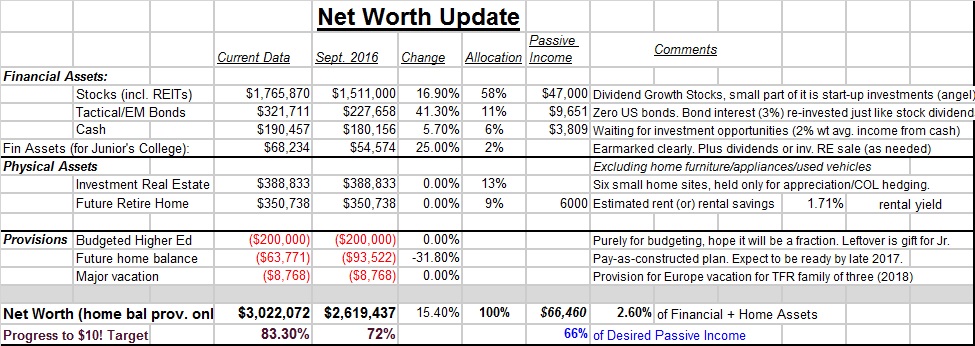

Here we go! The TFR Net Worth Data:

Some explanations are in order:

- Net Worth considers the payments remaining (~$64K) on our future retirement home because it is a commitment that must be completed (it’s a nice 3-bedroom condominium in a large Asian city, which will be ready by middle of 2018). It does not include the budget for Junior’s higher education or the major vacation line item as they are only a provision for now. Until we retire, the new condo will be rented out, and I have put a conservative rental figure just to estimate potential passive income.

- The provision of $200K for Junior’s higher education is purely a budgetary figure, so hopefully, it won’t cost that much! The assets clearly earmarked on Junior’s name are at $68K (all in stock index funds) but we will supplement this with other assets for college. We didn’t want too much money sitting directly in Junior’s name, as that may disqualify him from some financial aid opportunities.

- Stocks are primarily my dividend growth stock portfolio, a few index ETFs and about $100K worth of private/angel investments that I have taken at cost (to learn more, see here). My stock portfolio is on track to generate passive income of about $47K for the year 2017, about 10% more than in 2016.

- Bonds are focused on emerging markets and other developed countries, and I have zero US bonds. The interest rate is therefore a bit higher than equivalent tenure US bonds, but volatility is also higher with emerging market bonds.

- Cash holdings (I include some short-term bonds here) are simply those waiting for investment opportunities, and to pay for the $64K in our future home’s outstanding balance. I have chosen to buy the condo without taking any loan because it is a ‘pay-as-constructed’ deal spread over 4 years (common in Asia) so I could pay it off with job savings. In case you are wondering why did I not take advantage of low mortgage interest rates, remember they only apply for properties in the U.S. American banks don’t offer attractive interest rates for properties in Asia, and the banks in Asia charge high interest rates and bury you with paperwork before they process your mortgage application. Once the condo is paid off, the cash holding will be kept at no more than 1-2 years of living expenses but even that I may reduce to zero when opportune times come in the market.

- Investment real estate refers to six small home sites in Asia (sorry, can’t get into more specific location), in ‘bite-size chunks’ if you will, that can be sold off individually to hedge currency risks in the future. This is important as we plan to spend significant time there. I have covered this idea in more detail here. You may observe that this line item shows no change in value from a year ago. That’s because it is hard to get frequent updates on value of investment land in Asia, but I am confident that my estimates are on the lower side by 10-20%.

- Total passive income from all the different asset types is estimated (from 2018 onwards) at $66K. In the location of our choice in Asia, this will easily cover all our estimated living expenses and then some. However, since we are planning long stays in both U.S. and Asia with significant travel in-between, we wish to have $100K in annual income, so currently my passive income covers only 2/3rds of our desired income.

- The 2.6% that you see as my passive income ratio is a ‘blended average’ of all the passive income divided by all the financial and retirement home (imputed rent) assets. I track this purely for informational purposes, and to check how much leeway I have in increasing my passive income. For example, if I trade a zero-yielding but fast-appreciating asset (like Alibaba stock, held only for price appreciation) to a cash-flow generating asset (like a dividend stock).

- There is nothing special about the Sept. 2016 reference point in the table. I just wanted to include a previous reference figure to show progress – I don’t calculate net worth frequently as many bloggers do. I update barely every few months or so, though the figures change daily. Clearly, the last one year has been good in the markets, so that combined with my savings, have delivered decent portfolio growth.

- On the net worth front, we have crossed the $3 million milestone for the first time. We are currently at 83% of our $10! goal. Put another way, we are 17% short of the goal, so the grind continues….

- In case you are wondering, we qualify as a prodigious accumulator of wealth (PAW) as per Prof. Stanley’s formula. This indirectly means our current household income is much lower than what our net worth would predict. This is a result of several factors, which probably deserves its own post.

Just your average millionaire.

In real life, I fit the basic profile of a typical interviewee in Prof. Stanley’s book “The Millionaire Next Door”. I drive a 3 year old mid-level car, live in a spacious but not luxurious rented house, my son’s school is far from fancy and we eat out once a week in average but decent restaurants or take-out places.

We keep an overall tab on our spending but don’t watch daily expenses like a hawk (that would be miserable for me). Besides, it’s doing the big things right that matters. All these assets have been built brick-by-brick, through years of diligent saving, sensible frugality and patient investing right through the dog years. We have a maid to help us with some household chores and we also have a loaded cable package, so we are not exactly ‘frugal’ by some definition. The purse strings have loosened a bit recently but it didn’t start out this way!

I have never felt rich, may be because I had a different experience of the 1% growing up. I remember all the ‘sacrifices’ it has taken to get here, but having seen middle class life in Asia and Africa, I realize the people who consider themselves middle class there may not agree with what is considered ‘middle class’ in North America or Western Europe.

So, what are the ‘sacrifices’ I am talking about?

Buying only used, fuel-efficient cars (even after I entered management), living in modest rentals, buying the cheapest bulk laundry detergent, buying used toys, carrying leftovers for lunch or even extending into two more meals, bulk buying of on-sale beans and noodles, reusing grocery bags for garbage, buying clothes at Wal*Mart or K-Mart, picking up old TV and couch thrown on the curbside of mansions, rooming with three others to split rent (in grad school), re-purposing old, chipped furniture for new uses using Quikfix (old end-table becomes a new TV stand!) and…..

…pursuing hobbies that were free of cost, rare driving vacations in a packed compact car with friends to share costs, buying cheapest auto insurance and driving safely (despite the urge of my youth to floor the gas!) so that my premium stays cheap, and calling the once-a-week hogging at the local Pizza Hut a “luxury” and looking forward to it the whole week! Not to forget, sleeping on the floor, an old couch and then on a used mattress (in that order) in my 20’s until early 30’s before buying a new bed with a plush new mattress (I remember feeling decadent the first night I slept on it!).

What do you think about the journey and where we are at? Please share your views below. I don’t intend to put out frequent net worth posts, but this gives you a good indication for where we are tracking versus the financial goal used as a namesake for this website. Of course, this website is about much more than net worth and income tracking, and I will stay true to the Ten Factors.

Happy journey, my 10! friends.

Raman Venkatesh is the founder of Ten Factorial Rocks. Raman is a ‘Gen X’ corporate executive in his mid 40’s. In addition to having a Ph.D. in engineering, he has worked in almost all continents of the world. Ten Factorial Rocks (TFR) was created to chronicle his journey towards retirement while sharing his views on the absurdities and pitfalls along the way. The name was taken from the mathematical function 10! (ten factorial) which is equal to 10 x 9 x 8 x 7 x 6 x 5 x 4 x 3 x 2 x 1 = 3,628,800.

16 comments on “Counting The Marbles”