Added 7/12/2018: Nominations for the 2018 Plutus Awards are now open. If you like what you read here, please consider nominating tenfactorialrocks.com in all the relevant categories! Please submit your nominations here! Only one submission per IP address, please! Thanks a lot for your support!

Howdy, folks! My last article on ‘safest’ withdrawal rate generated quite a few positive comments except a couple of nasty zingers. Of course, I rejected the two nasty ones while moderating the comments (a privilege of being the owner of this website). If you came straight here, read that article first to get the context.

One of the comments from a diehard 4%-er was particularly nasty saying that for all he knew I could be “a 30-year old loser living in mom’s basement” and that I had no “right” to impugn the outstanding work done by the Trinity researchers on safe withdrawal rate (SWR) and William Bengen (original advocate of the 4% “rule”).

Far from casting any doubts on their work, in fact, their work paved the way for people like me to tweak and improve upon the results. So, I am grateful for the work of original SWR researchers and those that followed. I am reminded of the following quote from Isaac Newton about how we should respect all prior work done in important fields of human advancement. I consider SWR as important a field of study as any scientific phenomenon – because it saves the human working class from the drudgery of life-long work for earning a liveable income.

“If I have seen further it is by standing on ye shoulders of Giants.” Sir Isaac Newton

While the aforementioned nasty comment didn’t detract me from standing on the shoulders of SWR Giants, I opened my mailbox to find this nice mail from a long-time reader Terry.

“Roman,

I have always been a huge fan of your work on this site. Ten Factorial Rocks, while funnily named, puts out consistently outstanding stuff. Whenever I read your articles, I feel a level of authenticity that I rarely find in many other blogs on personal finance. I know this website isn’t designed to make money, and makes perhaps chump change, if that, so that’s not your motive. That adds to the appeal of this site because whenever you retire, you will be withdrawing from your portfolio and won’t have any side income (just like me). I am often amazed you are finding time to post meaningful articles despite your busy life as a corporate manager and being a road warrior like many of us, and also that you moved halfway across the world for your company. I certainly wouldn’t do that!

Yet, as a long-time reader, your most recent article on “What is the SAFEST Withdrawal Rate” really disturbed me. Having recently retired (early) from a demanding corporate job, I was – like your Adam example – quite content with your 3.27% ‘ultra-safe’ withdrawal rate, a number also supported by others like Early Retirement Now who I respect. On my portfolio, that works to $50,000 a year in safe withdrawal, enough to fund our expenses and our travel. I expect social security to kick in under 10 years.

Now, you have brought the SWR down (mercilessly!) to 2.6%, which is a 20% reduction. To me, it’s a real reduction of $10,000 in annual spending 🙁 My lovely wife and I have to forego our long vacations in Europe or South America to save this kind of money which, sort of beats the purpose of my early retirement! We can certainly live with $40,000 a year, but that won’t be much “living” for us, even in Florida.

I am writing to check if this isn’t some sort of sarcastic (or “gotcha”) article aimed at nervous nellies who are constantly questioning their withdrawal rates and chronically under-spending.

Worried in Florida,

Terry”

Well, Terry, thank you so much for this note! I never realized my work could have so deep an impact on any reader. Your mail has inspired me to keep up this website and continue to post high-quality content, no matter how infrequent that is, due to my work commitments.

No Terry, that wasn’t a “gotcha” or a merciless post, but your mail tells me a clarification is in order. So, this article is for you, Terry, and for many others considering retirement in these times of high market valuations.

Have no CAPE fear, the friendly Sheriff is here!

First, please allow me to clarify that my previous article was aimed at a specific audience, one that is aspiring to retire very early (30’s) and have a strong certainty-seeking mindset (you know, the kind that looks for 99% or 100% “success probability” in retirement simulation – though that is really not all that important).

The previous article brings in a key point about SWR not being a fixed number but a variable one based on prevailing market conditions. High valuations bring risk of future under-performance, and this risk must somehow be considered in portfolio withdrawals. This was the main message of my previous article.

After that, I brought in the following formula as a good way to bring in current market valuation (with reference to ten-year average earnings), commonly known as Shiller’s P/E ratio or cyclically adjusted price earnings (CAPE) ratio.

SWR = a + b * (1 / CAPE)

Then, I went on to present the most conservative of all values for a and b, which led to this formula:

SWR = 1.0% + 0.5 * (1 / CAPE)

I deliberately chose very low values for a and b because I considered two important assumptions:

1) Very early retiree (in 30’s) and

2) Desire to retain the portfolio’s value at the end of retirement (despite many decades of retirement withdrawals).

These two conditions impose major restrictions on what you can withdraw, especially if you are retiring at a time of high market valuation (that is, high CAPE).

Think of ‘a’ as the independent factor that governs the baseline withdrawal from your portfolio no matter what. The ‘b’ factor is a ‘dampener’ in the equation that recognizes that you cannot withdraw the entire earnings yield (that is, 1/CAPE ratio). The factor ‘b’ being at 50% (that is 0.5) limits the amount of earnings yield that can safely be withdrawn, leaving the rest of the earnings yield to be reinvested- so to speak – back into the growth of earnings from those corporations.

Some of you may wonder if the second factor of the equation is truly market dependent, why not have just that alone and spend the earnings yield no matter what. So, if CAPE is at 33, and the SWR is simply 1/CAPE, then that gives a withdrawal rate of 3.03%. Nothing wrong with this approach, and some way well do that, but I find it analytically less rigorous.

I prefer the two-factor approach because it recognizes that there is always going to be fixed income (even from a 100% stock portfolio) no matter how dire the economic situation and that income is at least 1% (as per the above formula where a is set at 1%). In reality, that fixed income baseline will be 2%-2.5% in most portfolios, but that’s not conservative enough for a rigorous SWR formula to stand the “test of time”. The ‘a’ factor is particularly useful in real-life portfolios that have some fixed income component (say, 20-40% bonds).

Compounding is not just a one-way street Withdrawals a reverse of this image. Image source: moneyunder30.com

I will avoid getting into the advanced mathematics of whether ‘b’ can be higher or ‘a’ can be higher, or both. Each relaxation brings in a different type of future performance assurance that the market rarely provides. From what I have read, I wouldn’t play with the ‘b’ variable and only have the intercept (that is, the ‘a’ factor) change with each decade in retirement planning horizon. In so doing, I have again retained the assumption that the retiree wants to have most, if not all, of the portfolio remaining at the end of his/her retirement.

Even if you don’t have any legacy interests, this is a critical assumption to retain because this is the cushion that most retirees need to handle any unexpected expenses during retirement or cover the expensive cost of end-of-life care in the last few years of retirement. Either way, regardless of your retirement age, this is an assumption that I feel is worth retaining. This will naturally put a downward pressure on your withdrawal rate.

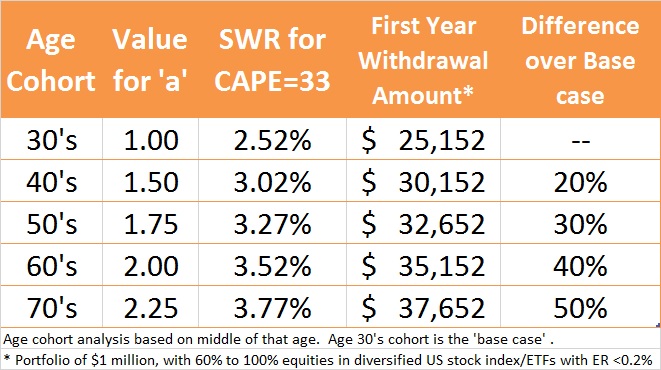

The variable SWR formula that keeps ‘b’ fixed and ‘a’ variable, based on the above is:

SWR = a + 0.5 * (1/CAPE)

Considering the above, I present the following table that considers a fixed ‘b’ @ 0.5 but a variable ‘a’ depending on your age at the beginning of retirement. So, Terry, and people like him in their mid-50’s who have a shorter retirement horizon than those in 30’s can benefit from higher inflation-adjusted withdrawals without worrying about running out of money.

Dealing with CAPE Fear

Some of you would notice the bigger step-up in a (0.5 jump, that is, from 1 to 1.5) from 30’s to 40’s and relatively smaller jumps (of 0.25) for subsequent decades. A main reason for that is the benefit of sequence-of-return-risk being reduced after the first decade of retirement. That risk is front-loaded, meaning that those who retire too early face it in their first decade, and not so much in second or later decades.

There must be some advantage of delaying early retirement by a decade, right? 🙂 Turns out that advantage is highest when you jump from 30’s to 40’s. So, rejoice if you couldn’t retire in your 30’s!

This SWR formula is still conservative.

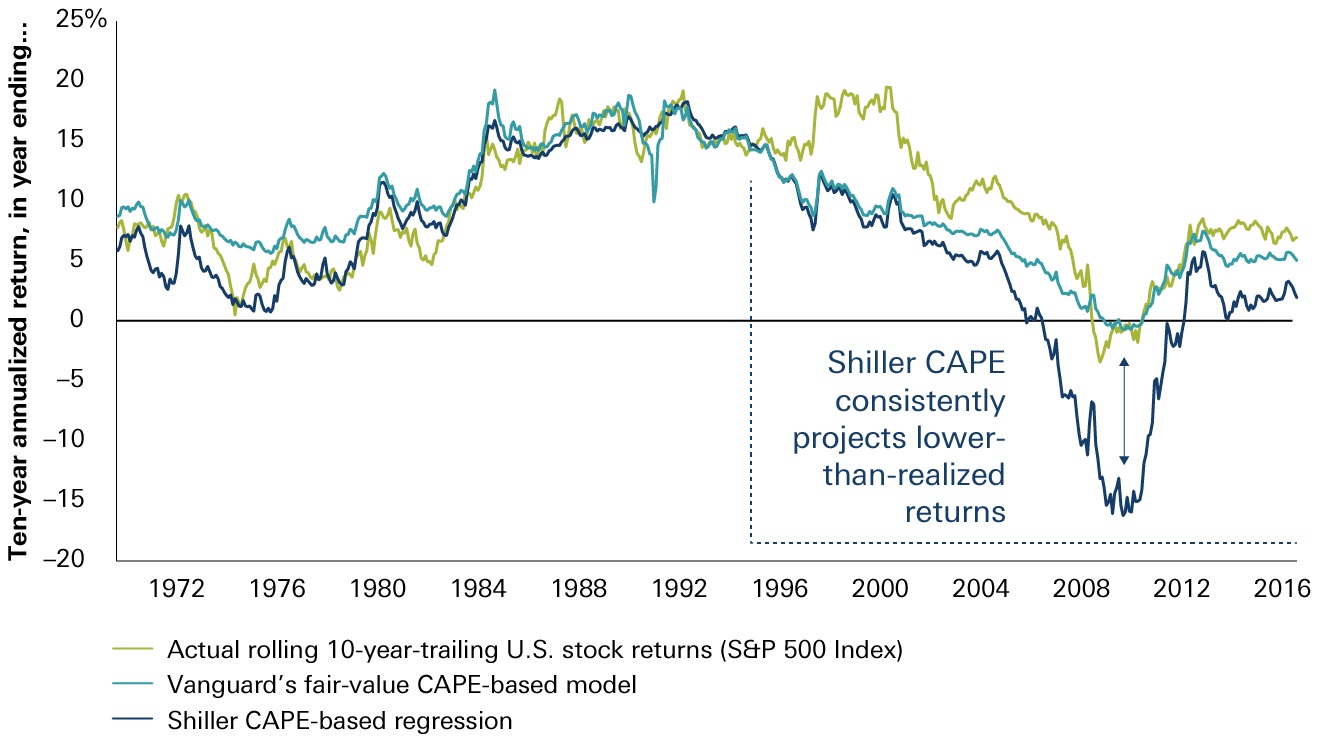

Says none other than Vanguard. You want more proof whether this is the “safest” way to get to SWR? In a recent publication from Vanguard, the following chart appears.

Source: Chart from Vanguard article.

Their “fair value” CAPE would give higher SWR than Shiller CAPE, because the 10-year forecasted return from S&P 500 is higher from their methodology than Shiller’s CAPE-based forecast. Vanguard’s research shows that while CAPE-based formula (like my table above) is well-founded, it is very conservative since it doesn’t consider prevailing interest rates. Despite the Federal Reserve slowly raising interest rates, we are still in a very low rate environment, and will likely be so for years to come, by which time – who knows – a recession might come, triggering the Fed to reduce interest rates.

Also, consider that my table showing age-adjusted, CAPE-informed SWR doesn’t consider social security or pensions or any side income (which certainly helps). To the extent any additional income is coming in the future (within 10 years, as in Terry’s case), you simply spend that for additional lifestyle or travel expenses. Or for those still nervous, use half of the social security/pension for those memorable experiences and the remaining half to reduce the portfolio withdrawals.

There is no one right way to spend in retirement! You have earned the right to live it up in retirement, tuned to the actual portfolio value at the time you make those annual or one-off withdrawals.

Raman Venkatesh is the founder of Ten Factorial Rocks. Raman is a ‘Gen X’ corporate executive in his mid 40’s. In addition to having a Ph.D. in engineering, he has worked in almost all continents of the world. Ten Factorial Rocks (TFR) was created to chronicle his journey towards retirement while sharing his views on the absurdities and pitfalls along the way. The name was taken from the mathematical function 10! (ten factorial) which is equal to 10 x 9 x 8 x 7 x 6 x 5 x 4 x 3 x 2 x 1 = 3,628,800.

10 comments on “SAFEST Withdrawal Rate – Part 2”