Many people read a bunch of blogs on investing and think they have it pat, right? Even without a detailed analysis on indexing vs. dividend growth, the prescription sounds simple enough:

a) Save money

b) Buy a low cost stock index fund

c) Repeat steps a and b till you make serious bank and then retire.

Except that it ain’t that simple!

Everybody speaks about the benefit of compound interest. Sure, Einstein might even have called it the 8th wonder of the world. But nobody tells you that you suffer long years for it. An inordinate length of time when it seems you are doing the heavy lifting and your portfolio looks like a dud that just barely moves forward.

Welcome to the dog years of investing! This is the hard part not many talk about.

Compounding is a slow friend

Wish compounding was like magic beans.

Imagine either an equity index fund or a diversified dividend stock portfolio generating a total return of 8% per year, compounded monthly.

Dividends are part of the total returns, so for the purpose of this article, I am not separating out between dividends and capital gains. We will assume all dividends are re-invested.

You, a diligent investor, put in $125 a month faithfully into the fund. Or you buy a good dividend stock every few months. I chose a low monthly savings figure because that’s closer to the reality of what many people are able to sock away.

Magically, but for the sake of simplicity, we will assume the returns are a precise 8% year-over-year. Obviously, this is not going to happen as real returns have a wide range (standard deviation, if you want to get technical). However, the overall returns in equities average around this 8% annual figure over long periods, so this is not a bad assumption to make.

Despite all this, it is still a very difficult journey.

The chart from Atlantic Financial shows this example, along with 10% and 6% return cases, for reference.

Oh, the pain of compounding.

Take the black line (8%), which is the case we are talking about. As a diligent saver, putting in $125 month-after-month, gets you to only about $25,000 after 10 looooong years. This is even assuming a steady march of progress in market returns, with no bear markets to drag down the value in-between. Severe bear markets in early years can demotivate many people and they get off the investing train.

After 15 years of investing and the steady 8% returns, your portfolio is struggling to even reach $50,000. Fifteen years of toil! Regular, diligent savings of $125 per month gets you, at best, a down payment on a home. By now, you have invested a total of $22,500 over the 15 year period, and you end up with a portfolio barely twice your total investment after 15 years.

You can use a different monthly savings figure to proportionally scale the portfolio value after 10 and 15 years. With a barely $45K nest egg after 15 years, you will wonder, even the famous 4% rule gets you to a monthly income of only $150. With that kind of withdrawal, you can pay for your phone, internet and netflix subscriptions or a utility bill at best.

You may wonder what happened to the promised land in compounding?

These are what I call the dog years of investing. Crossing the first 10-15 years of investing is the biggest challenge most investors face before they become true believers of this principle. If you manage to survive this period, better results are ahead.

The Speed of Compounding

Notice what happens beyond the 15 year period on the black line. In just 5 years, your portfolio crosses $75,000, which is more than 50% of what you had after 15 years of investing! The returns you earned in Years 11-15 are more than the entire period from Year 1 to 10.

Suddenly, time feels compressed. Your portfolio seems to have got a life!

In 10 more years, you cross $125,000, which is 6 times what you had after the first 10 years. At the end of the 30-year investing cycle, you end up with a little shy of $200,000.

Here’s the important part. A massive $150,000 (or nearly 75% of the portfolio value) came in during the second 15-year period of the 30-year cycle. Hello, Compounding!

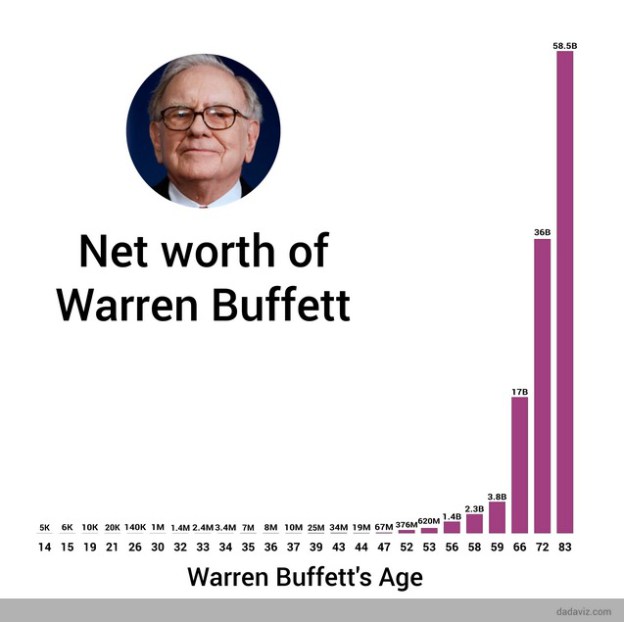

This has, in some ways, a parallel to the other extreme example of wealth compounding of an exceptional investor – the net worth of Warren Buffett. More than 99% of his wealth was created after his 50th birthday!

Late bloomer, eh?

The biggest takeaway for anyone from this article should be patience.

This is what Charlie Munger calls assiduity (the ability to sit on your ass and do nothing!). Buffett has called this type of long-term investing as watching paint dry.

In other words, don’t expect short-term excitement here. Get your kicks on Route 66, but not on the route to your retirement!

Finally, I leave with you a timeless message from a wise one in Star Wars.

Raman Venkatesh is the founder of Ten Factorial Rocks. Raman is a ‘Gen X’ corporate executive in his mid 40’s. In addition to having a Ph.D. in engineering, he has worked in almost all continents of the world. Ten Factorial Rocks (TFR) was created to chronicle his journey towards retirement while sharing his views on the absurdities and pitfalls along the way. The name was taken from the mathematical function 10! (ten factorial) which is equal to 10 x 9 x 8 x 7 x 6 x 5 x 4 x 3 x 2 x 1 = 3,628,800.

Pingback: Rockstar Rumble, Round 3, Posts 17-24 - Rockstar Finance

Pingback: Rockstar Rumble, Round 2, Posts 33-40 - Rockstar Finance

Pingback: Rockstar Rumble, Round 1, Posts 65-72 - Rockstar Finance