Some time ago, I wrote an article about the famed 1%, suggesting it all depends on how you measure it and some of you may even be part of it!

The 1% means different things in different contexts.

Apathy Ends wrote a post titled Can you do 1% better showing how even a small increase in savings can add up.

Today, I am going to write about a different 1%.

The 1% extra effort. Not once a year, but every day.

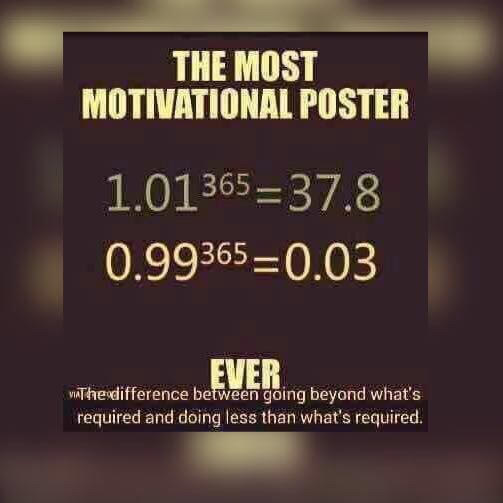

There are few things in life where 1% makes such a difference. A person putting in just an additional 1% effort beyond ‘average’ every day, ends up being 38 times better than average as the compounding math shows. On the other hand, if you slack just a bit compared to average (by just 1% each day), in one year, you are next to nothing! You achieve 97% worse results than the average by slacking just a tiny bit below the average every day.

The differences are minor when measured over one day or even a week (1.01^7 = 1.07 vs. 0.99^7 = 0.93). Most of us cannot tell the difference between someone just 7% better than average or another guy just 7% worse than average. This is what compounding does – it is a slow friend, as we saw earlier. On the flip side, it’s also a slow but sure killer as we will see later in this article.

These everyday habits compound beautifully (or mercilessly, if you are in debt) to make a huge difference over time. Over 365 days, the difference is mind-boggling as the chart above shows. This may be simple, but certainly not easy. Most of us don’t get there because we don’t have the patience or the discipline it takes or in some cases, life intervenes in different ways to throw us off the path of continuous improvement.

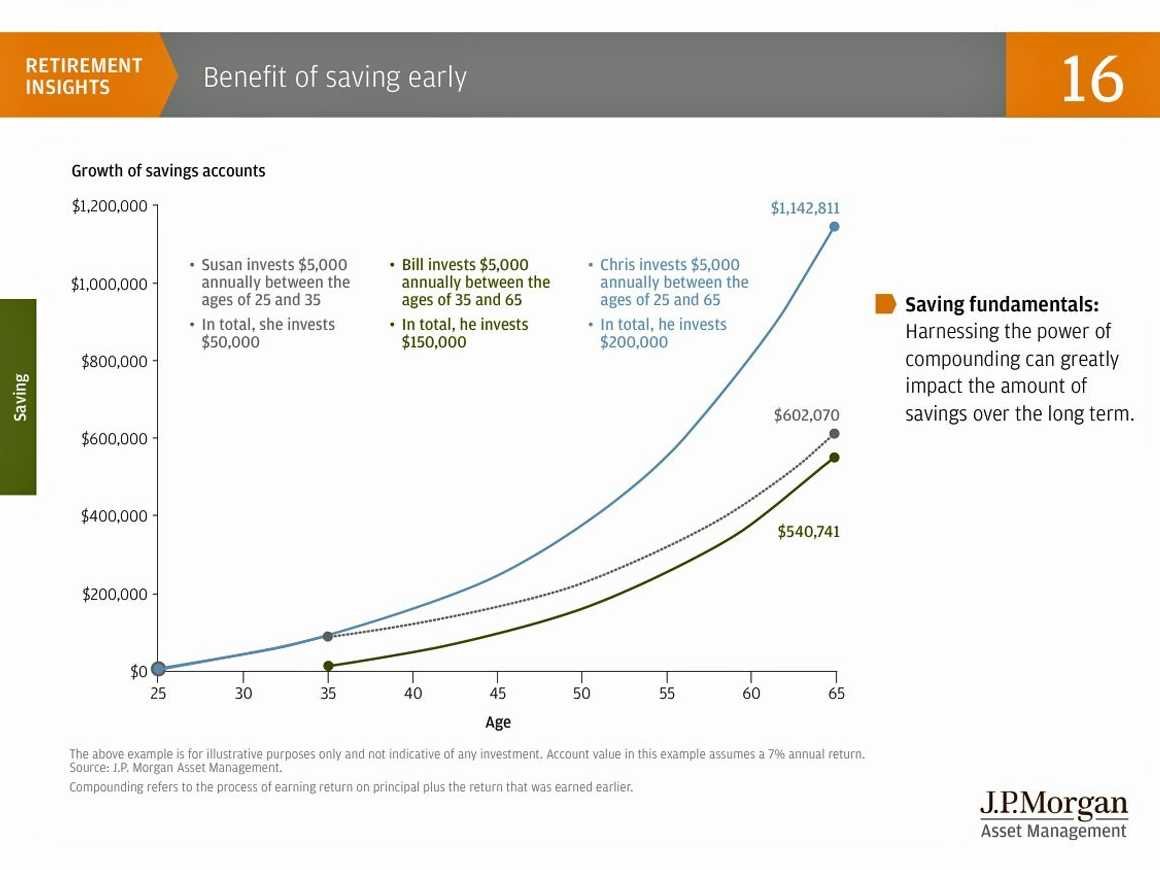

No matter what, the end result over long periods of time is obvious. When I first started working, a financial planner from the fund company that managed our 401(k) accounts made a presentation that stuck with me for a long time. It was about two workers, one who contributes to her 401(k) for the first 10 years and then nothing. The second person contributes nothing for the first decade, but then contributes the same monthly amount for the next 30 years. The outcome was staggering!

The ‘1%’ in action! The chart that influenced me to start saving early (source: JP Morgan Asset Management)

Despite investing three times as much money as Susan, Bill still ends up with an retirement portfolio balance lower than Susan. How terrible for Bill! This chart is a wake-up call for those delaying their investments till their 30’s or 40’s instead of 20’s. When you start in your 40’s, the growth (not shown in the chart) is even worse than Bill’s case who starts in his 30’s and still under-performs Susan. Basically, someone starting to invest 10 years later than Bill can never catch up with Bill even if they put in the same monthly amount for the rest of their life!

[tweetthis]Compounding is great if you start early but brutal if you delay.[/tweetthis]

Notice how the third investor Chris, who regularly puts in money throughout his working career, ends up with a balance exactly the sum of both Susan’s and Bill’s portfolio balances. This isn’t surprising since Chris’s investment profile is exactly Susan’s and Bill’s put together. While Chris may not be calculating it this way, but the fact is that more than half of his $1.1 million portfolio has come from just the first 10 years of his investing journey while the remaining 30 years of his contributions have resulted in less than half of the total balance!

Just like the first chart, make a decision to do that extra 1%…every day, every week and every year. Your future self will thank you later.

Compound interest: A simple formula that can change your life (Image Source: moneyunder30.com)

Keep doing this and you will reach the real 1% club someday, and who knows, maybe even the top 0.01%!

This is what allows you to get to F-U money as Jim Collins puts it. This is also the path to reach financial independence. This is also the route to the $2.5 million net worth, aka ‘fortress of solitude’, as eloquently cussed by John Goodman in the movie The Gambler.

But the flip side is painfully worse…

As great as investment compounding works, debt compounding also works, but much worse. There are no simple charts I could find that shows how spiraling debt can ruin people’s lives but I found an interesting video that captures the concept using water in a glass and jug.

This example uses credit card debt – the worst kind of debt – and one that carries a very high interest rate, typically 15-25%. Many have the habit of paying only the only the minimum balance each month, so the debt rolls over into the next month and so on. In this video, they use 17% as the interest rate to show how you pay over 6 times the borrowed amount and it takes 36 years to pay off the debt! And that’s without taking on any more debt during the 36 years.

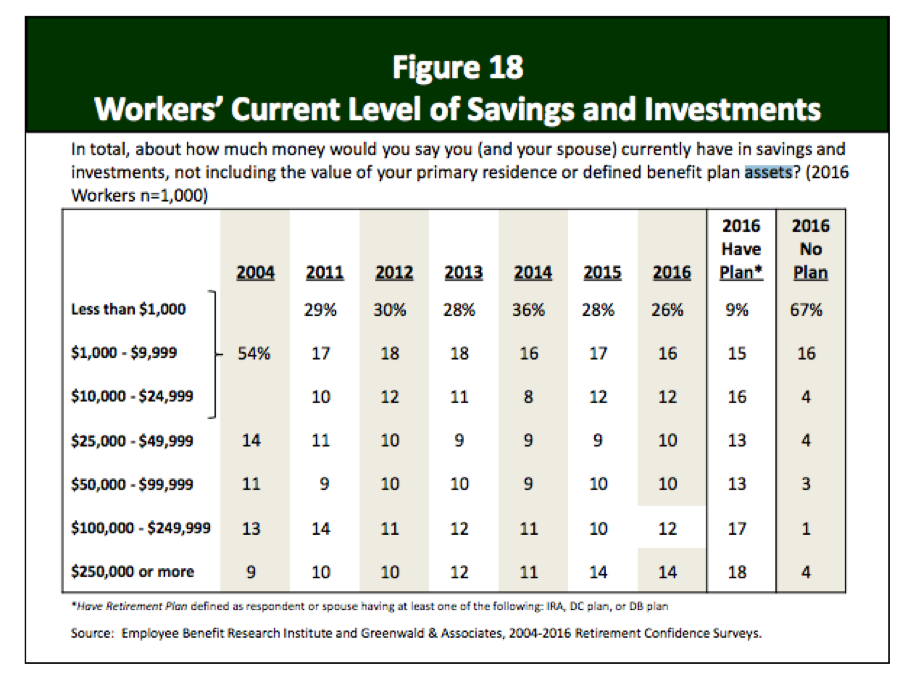

Now that’s scary! Even well-educated people get into difficult debt situations, and need a wake-up call. The video offers a clue to the massive gap in savings among the affluent Americans and all others.

Most Americans are addicted to debt. Debt addiction is like alcohol addition – just one experience often paves the road to hell. The real tragedy is that both addictions are preventable with the right education early in life.

The retirement crisis I wrote about earlier is just a result of the consumer debt crisis that every affected individual needs to tackle.

Not doing the 1% extra can lead to this crisis.

Nothing more scary than being old and penniless.

So, the choice is yours. Do you want to be on the asset compounding side (or) the debt compounding side?

I know a beer-guzzling young man in my extended network of friends and family who lives by the motto: It’s 5 o’clock somewhere! I realize many young people like him see it as their rite of passage to go on binge drinking or keep their ready supply of alcohol handy no matter what time of day it is.

I don’t know about 5 o’clock, but if you are a young drinker reading this, consider this post as your f*ing 6 AM wake-up call!

Raman Venkatesh is the founder of Ten Factorial Rocks. Raman is a ‘Gen X’ corporate executive in his mid 40’s. In addition to having a Ph.D. in engineering, he has worked in almost all continents of the world. Ten Factorial Rocks (TFR) was created to chronicle his journey towards retirement while sharing his views on the absurdities and pitfalls along the way. The name was taken from the mathematical function 10! (ten factorial) which is equal to 10 x 9 x 8 x 7 x 6 x 5 x 4 x 3 x 2 x 1 = 3,628,800.

3 comments on “The Power of 1%”