Don’t think so? You may be closer than you think. Read on.

I grew up hating the rich because, in my idealistic younger days, they represented the anti-thesis of equal opportunity and egalitarianism. I heard stories from my parents about people who used their government connections to score sweetheart business deals, dodged their taxes, and were slave-drivers to the poor people they employed and who they treated like human waste. My parents used this example to steer me away from business ownership and towards ‘respectable’ professions in science, engineering and management, where you can have a good life and decent income without having to be at either of the extremes in wealth.

Consequently, I wanted ‘normal’ friends who I could hangout with along a roadside ice-cream truck after a hard-fought little league game, and where I could throw small pebbles into a little creek nearby. I hated even the idea of a rich kid who had servants to order around and run whatever errands that the prince’s whims demand. My admittedly biased notion of an arrogant SOB filthy rich kid (“Is there another kind?”, I used to wonder) did not go away till I later made friends with children of several well-off families. My outlook changed.

These new friends proved that good kids can also come from rich homes. My real understanding of the 1% started then. Finally, what sealed it for me was cute little Macaulay Culkin as the good kid of Richie Rich.

Given this background, when I read Credit Suisse’s recent report, I found out ironically that I am part of the global top 1% in wealth. Holy smokes, how did that happen? No inheritance, no stock option riches, no top-level connections and as far from Wall Street as you can imagine – just a regular guy is now part of 1%?!

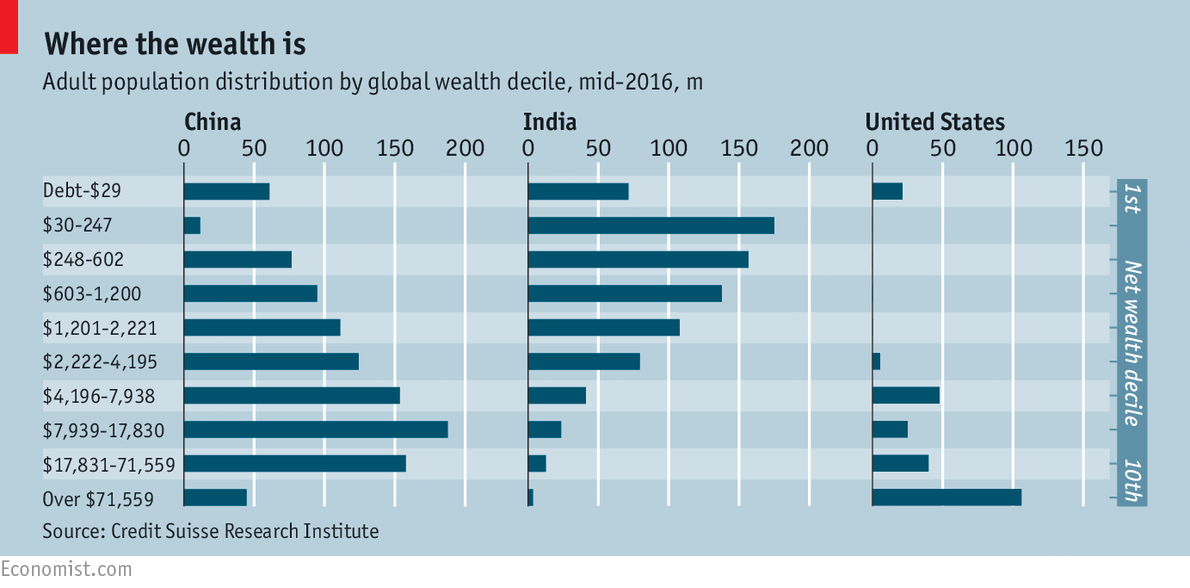

Truth be told, it takes less to be part of the global 1% than the American 1%. It ‘only’ takes $744,400 in assets to be part of the global 1%, but it takes more than $7 million to be part of the 1% in the U.S. I am nowhere near the American 1% definition. A global 1%-er needs 10 times more assets to be an American 1%-er, thanks to the many American fat cats who are wallowing in wealth. On the other hand, it takes ‘only’ $71,650 to be part of the top 10% in the world.

More than 100 million Americans are among the top 10% rich in the world! It’s no surprise then why our country is considered the world’s richest and why Warren Buffett says he won the biological lottery to be born in the U.S.

The skew of US and emerging China on wealth is clear (Source: The Economist, Nov. 23, 2016)

Here is the funny thing. I never consider myself a 1%-er. Even in my Rockstar Finance-featured article talking about the life of a 1%er, I reported being an apprentice to a real 1%er, a top honcho who I had the privilege to work for.

Even if you are not part of the global 1%, I bet a large number of personal finance bloggers and their regular readers out there are part of the top 10%. You only need to own about a third of a median house in the U.S and with zero dollars in your bank or retirement accounts to qualify among the global top 10%.

The real data about global wealth should tell you a few things straight away:

- You don’t need to be a millionaire to be a part of the top 1% wealthy people in the world. Contrary to USA Today’s discouragement about a million bucks, it is a big deal if you earned it through honest means.

- Early retirement in developing countries is viable and attractive, because your dollars stretch much further. It’s one of the few arbitrages left in the world. Healthcare is just one example. The earth awaits, indeed.

- With sensible frugality, smarter decisions on housing and efficient investing, you can certainly become part of the top 1%.

- Wealth is relative in comparison but absolute in spending. The countries and the people within those countries can move up and down the wealth ranking scale. Absolute wealth is a measure of relative prosperity among nations.

- Five billion people live on far less than what we think is even frugal. Granted, this is not out of choice, but the fact that’s where the bulk of the world is, shows that’s where the majority of lifestyles are. Chances are that they all aspire for themselves or at least their children to live as comfortably as you are living today.

The last point is a cause for much concern in the world. The top 10% of the world own an astonishing 89% of the total global assets. Of course, much of that is concentrated in the top 0.5% and even more in the top 0.1%. The 0.5-1.0% folks (the ‘bottom half’ of the 1%) would be professionals like me and other FIRE bloggers like Financial Samurai, Green Swan, the legendary MMM and Jim Collins, Physician on FIRE, the Canadian revolutionaries, Full Time Finance, Mr. Tako, Chad, the families of 1500, Joe and RoG etc. who are all living a ‘normal’ life (as each of us define it) while earning a decent professional (or passive) income, and all have reached this stage after investing their savings efficiently.

Some of us also worry about same issues like what is enough and portfolio longevity. So, don’t hate the 0.5-1%! The 1% group is extremely steep in wealth. It’s almost as if the top 0.5% are from another planet compared to the next 0.5%. Also, the bottom half (of the top 1%) are the folks who help the top 0.5% very rich people stay there. After all, the uber-rich need smart engineers, lawyers, scientists and accountants working for them.

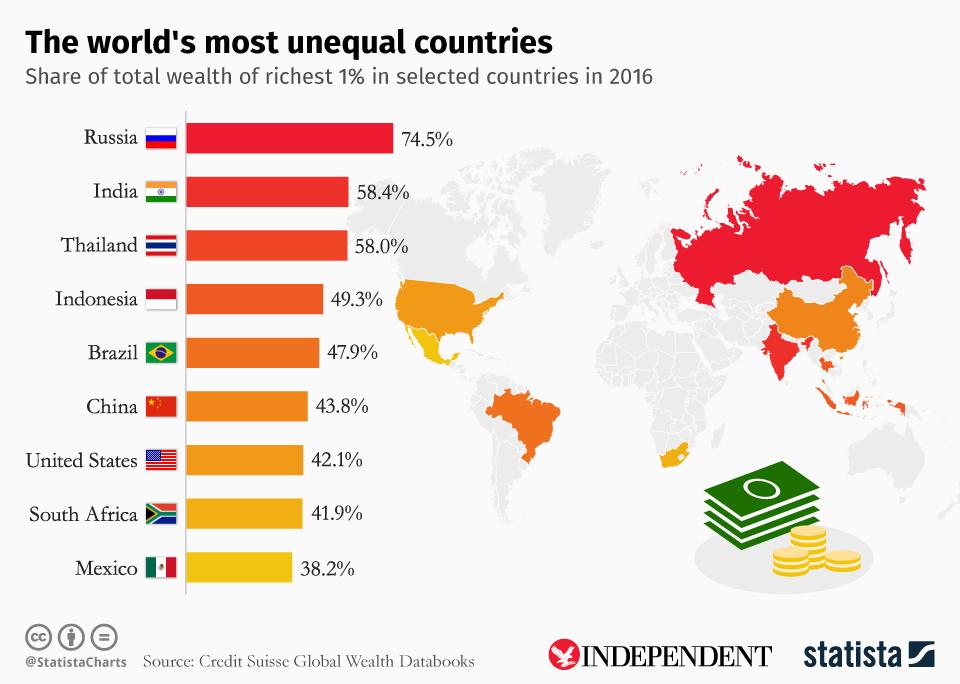

The real issue lies here:

Russia, India and Thailand are glaring examples of where the top 1% own more than half the total national wealth. Generally, the poorer a country’s per-capita GDP, higher the proportion of assets held by the top 1%. This is largely because of the reasons I started out this article with. Nepotism/cronyism, regulatory monopoly, relatively high cost of capital that stifles innovation, massive bureaucracy, and regulations to discourage new players – all together constitute a ‘cozy club’ for the entrenched elite in those countries. Other countries aren’t far behind.

It’s hard to put a precise number on how much assets should the top 1% own for a country to still work for the other 99%. Looking at societies that are perceived to be less unequal than others, I would guess that figure to be 25%. So, if the top 1% of wealthy people in a country own no more than a quarter of the country’s wealth, then I would guess that people would be relatively happier and more trusting of the country’s institutions and political system. Clearly, there is a very long way to go for the world’s largest countries to get there.

Until then, you can rejoice that you are part of the top 1% or top 10%. Or, at the very least, you have been given an opportunity to get there. If all this riles you up, well…take a number and get in line. That’s what I did two decades ago.

Raman Venkatesh is the founder of Ten Factorial Rocks. Raman is a ‘Gen X’ corporate executive in his mid 40’s. In addition to having a Ph.D. in engineering, he has worked in almost all continents of the world. Ten Factorial Rocks (TFR) was created to chronicle his journey towards retirement while sharing his views on the absurdities and pitfalls along the way. The name was taken from the mathematical function 10! (ten factorial) which is equal to 10 x 9 x 8 x 7 x 6 x 5 x 4 x 3 x 2 x 1 = 3,628,800.

6 comments on “You May Be Among The 1%”